HMO

PROPERTY STRATEGY

Explore the possibilities and discover the potential of HMO as a Buy-To-Let Strategy.

New to HMOs?

Learn the basics of HMOs as a buy-to-let investment strategy through our introductory video.

Below, we have provided more detailed information about Houses of Multiple Occupancy (HMOs) as a strategy for Buy-To-Let properties.

A Definition

What is a HMO?

A house of multiple occupancy (HMO) is a property where the tenants belong to more than two different households.

A household is considered to be a family unit. Therefore, if three friends decide to rent a property together, it will be classified as a House in Multiple Occupation (HMO). However, if two siblings and a friend want to rent a property together, it will not be considered an HMO.

Property Types

HMOs are typically freehold properties, however, given that a HMO by definition has to be more than two different households some larger leasehold apartments could also be used as HMOs. Smaller houses are converted from 2 or 3-bedroom single-family terraced houses to 3 or 4-bedroom HMOs by reconfiguring the layout of the accommodation. Bathrooms are often moved to either the ground floor or a new internal room is created within the property, this enables the old bathroom to be used as a new bedroom.

Let's take a look at some of the advantages and disadvantages of HMOs

HMOs have higher rental returns than single-family homes as they can be charged on a room-by-room basis generating a higher level of income.

With more lucrative buy-to-let strategies they often suffer from a lack of financing options, HMOs however, typically have a much larger range of mortgage products available as they can use many standard buy-to-let mortgage products.

As the tenancies for HMOs do not have any specific requirements i.e. students or vulnerable people as with student and social housing respectively, HMO values track much closer to the movement of the UK housing market. This presents a better prospect for the value of the property to increase over time.

HMOs offer a unique benefit in terms of their flexibility, while they are usually let to working professionals, if you wanted to lease the property to a housing association and change it to social housing you could, or you could use it as a short-term let such as Airbnb if there is demand in the local area.

The combination of more lending options to purchase, higher rental returns, higher growth potential and tenant flexibility make HMOs a desirable buy-to-let strategy and this means you will often find them one of the easiest buy-to-let properties to sell and exit from.

Although there are numerous benefits to owning HMOs, there are also some downsides to this strategy.

While HMOs are one of the most desirable buy-to-let property types, they are expensive to purchase compared to single-family homes in the same area.

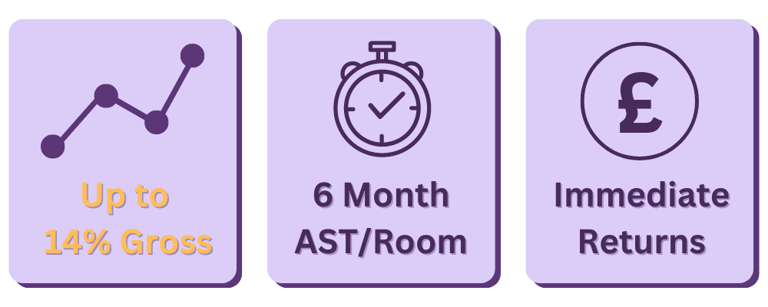

HMO tenants are typically found by letting agents on a room-by-room basis with a 6-month assured shorthold tenancy (AST). These contracts are short-term and only with a single person, which often leads to a higher tenant turnover.

HMOs have to meet higher levels of fire safety with certain pieces of equipment present such as a fire alarm system, interconnected smoke alarms on each floor and fire doors throughout with self-closers installed.

There are also more regulatory requirements when it comes to HMOs, the owner may need to get a licence from the local authority, fire regulations have to be met and in some areas, you are subject to Article 4 Directions which means you have to apply for planning permission from the local authority to convert a property from a single-family home to a HMO.

How much do I need for a HMO?

Cash Requirement

Depending on the area you intend to purchase in, the route you go down for HMOs, sourcing and converting a property or purchasing an existing HMO may not be too dissimilar in price.

Depending on the house prices in the local area, a starting budget of around £150,000 could be sufficient to purchase and convert a property for use as a HMO. However, various factors can influence this approach, and the actual cost may be significantly higher, particularly if the property requires extensive repairs or renovations as part of the conversion. As financing would typically be available for the property purchase, the cash requirement could be in the region of £70,000 but will need to cover the deposit, purchasing costs, renovations and licensing so may vary.

Another way to acquire one of these properties is by purchasing a property, which has already been converted to a HMO. The cost can vary depending on the location and condition of the property, but for a good starting point, a budget of around £200,000 should mean there are some opportunities available to you. Buy-to-let mortgages are typically available meaning a cash requirement of around £60,000-70,000 could be sufficient.

Sourcing, Converting and Renting

We've scored this one a 4 out of 5 difficulty if you're trying to source, convert and rent your own HMO.

Finding suitable properties isn't always too challenging however the price may go beyond the original list price due to the popularity of this strategy. Many property investors want to convert existing properties into HMOs making it more difficult to find a suitable property within your budget for the project.

Once you've acquired a suitable property, the conversion to an HMO can be a steep learning curve if you've not had much experience with it. Local authorities have different regulations for HMOs compared with single-family buy-to-lets so it's important to have a good knowledge of this within the local area you are purchasing.

As with most strategies, purchasing a property that is already being used for this purpose is easier than sourcing one and converting it yourself.

Freehold Houses in Multiple Occupation (HMOs) can be a bit harder to find as there are fewer of them on the market at any given time.

Once you own a HMO, it can be a relatively hands-off investment strategy if you use a management company to take care of the day-to-day tasks of owning the property. If you choose to manage it yourself you will have more work to do ensuring all the rooms are let at any one time to maximise your potential returns.

Purchasing Existing

Level of Difficulty

How much work is involved with HMOs?

Owner Involvement

When the purchasing element is removed from the equation and you focus on the ongoing ownership, HMOs have a medium level of involvement by the owner, however if you work with a local letting agent we think this reduces to a low level of involvement.

Because this type of property can be let to any tenants you approve it is often easier to find someone to fill an empty room. The property could experience more wear and tear because of the higher number of people living there so you may have to manage contractors for repairs on a more frequent basis than a single-family let. However, this would be covered by a letting agent if you enlisted the help of one.

Typical Returns & Timeframes

What should you expect from HMOs?

Exit Strategy

What happens if you want to sell and how easy is it to liquidate your cash?

Yes, it is possible to sell HMOs with tenants already living in the property, just like many other property investment strategies. If there is an existing tenancy agreement in place, it will typically be transferred to the new owner upon completion of the sale. The new owner will then start receiving rental payments directly from the tenants.

HMOs often have one of the easiest exit strategies as they can be used for multiple uses by the new owner, this increase in demand means there are likely to be more interested buyers when you decide it is time to sell. Coupled with the fact that the properties can often be purchased using a mortgage it further opens up the list of potential buyers.

Because of the wide range of potential buyers, selling via a high street estate agent should be possible and you would not necessarily need to enlist the help of specialist property sales agents, like you may need to with other specialised strategies.

Frequently asked questions

What does HMO mean in property investment?

An HMO (House in Multiple Occupation) is a rental property where three or more tenants from different households share facilities like the kitchen or bathroom. HMO investing is popular because it allows landlords to earn rental income from multiple tenants in one property, making it a high-yield investment strategy.

Why is HMO investment considered more profitable than standard buy to let?

HMO investment typically delivers stronger returns than standard buy to let because each room is let out individually rather than the whole property. This setup increases the monthly rental income and reduces the risk of a complete void if one tenant moves out. It’s a key reason why many investors are shifting towards HMO for buy to let strategies.

What are the main advantages of investing in an HMO in the UK?

The main benefits of HMOs as a property investment strategy include:

Higher rental yields compared to single-tenancy properties

Lower impact from void periods since other rooms can remain tenanted

Flexibility in tenant types (students, professionals, contractors)

Strong demand in areas with housing shortages or high tenant turnover

What are the risks or challenges of investing in an HMO?

While investing in an HMO can be lucrative, it comes with some challenges, including:

More complex management due to multiple tenants

Higher maintenance standards and safety regulations

Additional licensing requirements from local councils

Greater upfront costs for conversion and compliance

Is a specialist mortgage required to buy an HMO?

Yes, most lenders require a specific HMO mortgage for these types of properties. HMO mortgages differ from standard buy to let finance, often needing a larger deposit and sometimes previous landlord experience. Speak with a mortgage broker who understands HMO investment to explore your options.

What licensing is needed for a buy to let HMO?

In the UK, HMOs with five or more occupants from different households require a mandatory HMO licence. Some councils also have additional rules for smaller HMOs. To stay compliant and protect your investment, always check local authority requirements before proceeding with any HMO investment.

How does a HMO compare with traditional buy to let properties?

Compared to traditional buy to let properties let to a single family, HMO investing offers the potential for higher rental income but requires more hands-on management. It suits buy to let property investors who want stronger cash flow and are prepared to deal with extra regulations and tenant coordination.

What types of properties are suitable for use as an HMO in the UK?

Properties best suited for HMO investing are often larger homes, such as terraced or semi-detached houses, with space for multiple rooms and shared facilities. Ideal properties are close to town centres, universities, or hospitals, where demand for shared accommodation is strong.

How can I manage an HMO buy to let property effectively?

Managing an HMO for buy to let success requires attention to tenant relationships, maintenance, and legal compliance. Many investors choose letting agents with HMO experience or specialist HMO letting agents to handle the day-to-day running of the property. This supports a hands-off approach to HMO investing.

Is HMO investing a good option for first-time property investors?

HMO investing can be a great choice for first-time investors looking to maximise returns, but it does require more knowledge and effort than a standard buy to let. If you're new to property investment, consider starting with a ready-made, fully managed HMO to reduce the learning curve.

Registered Company Number: 15439671

Seven Generations UK Limited

Copyright © 2025 Seven Generations UK Limited, All Rights Reserved

PRS Membership Number: PRS043981